All Categories

Featured

Table of Contents

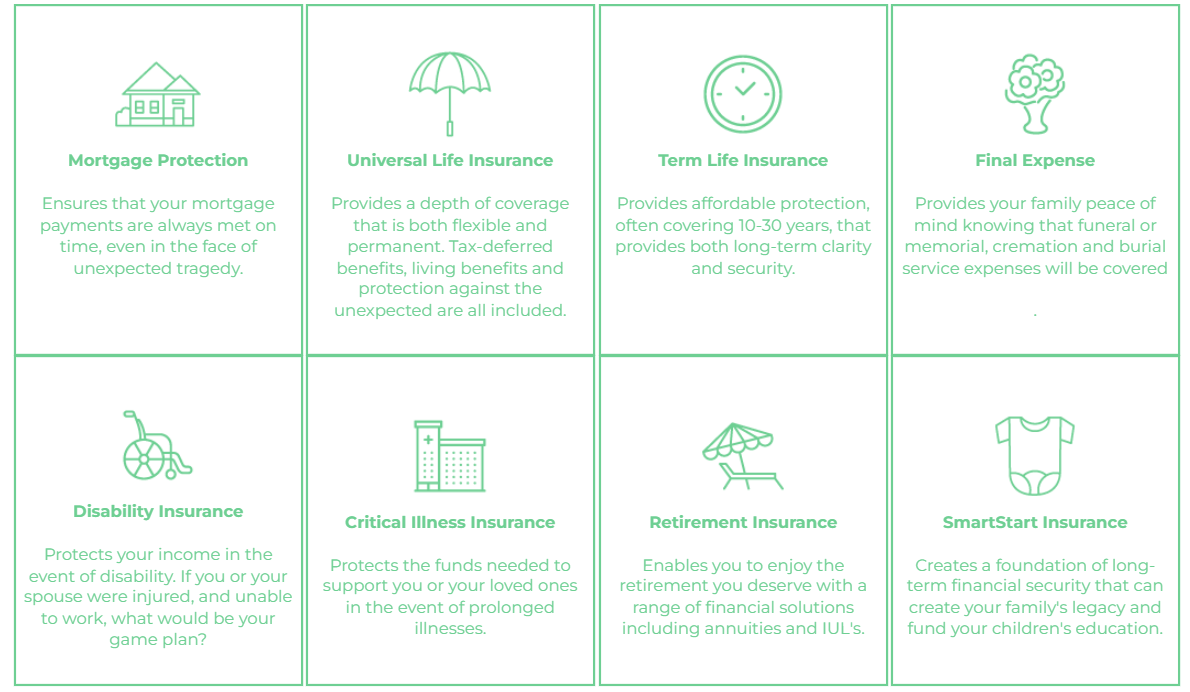

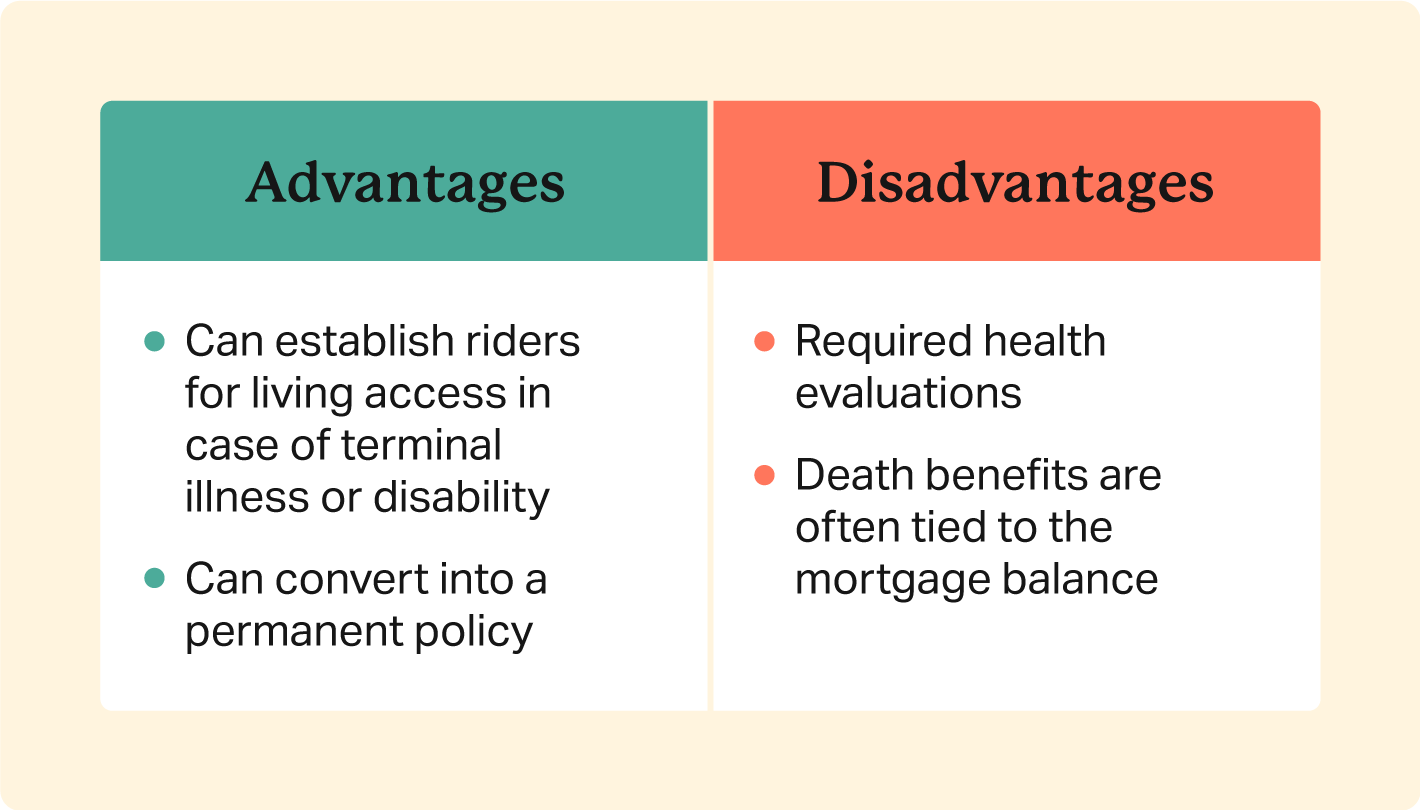

Home mortgage life insurance policy provides near-universal protection with very little underwriting. There is typically no clinical evaluation or blood example required and can be a beneficial insurance plan alternative for any kind of home owner with significant preexisting clinical conditions which, would certainly prevent them from buying traditional life insurance coverage. Other advantages include: With a mortgage life insurance plan in position, successors will not have to fret or question what could occur to the household home.

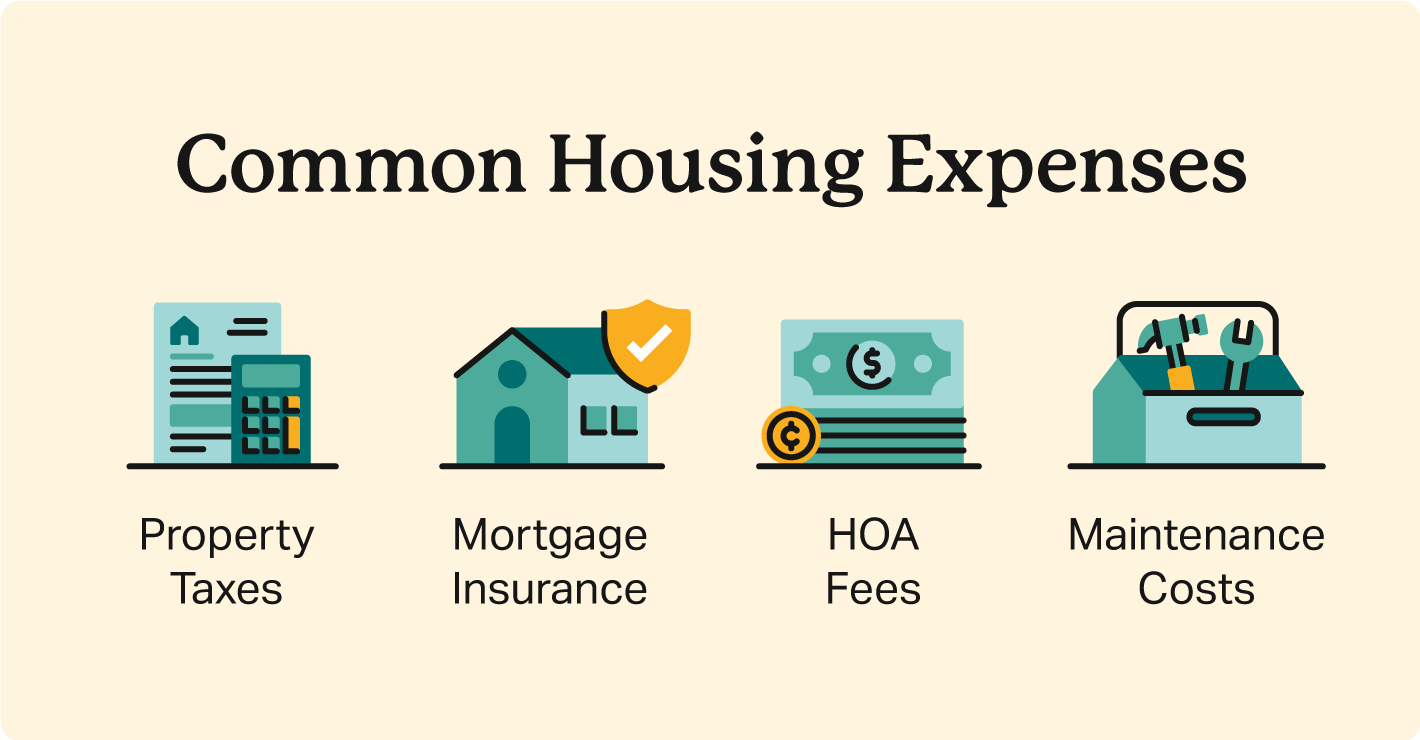

With the mortgage paid off, the household will always have an area to live, offered they can afford the real estate tax and insurance coverage annually. mortgage insurer.

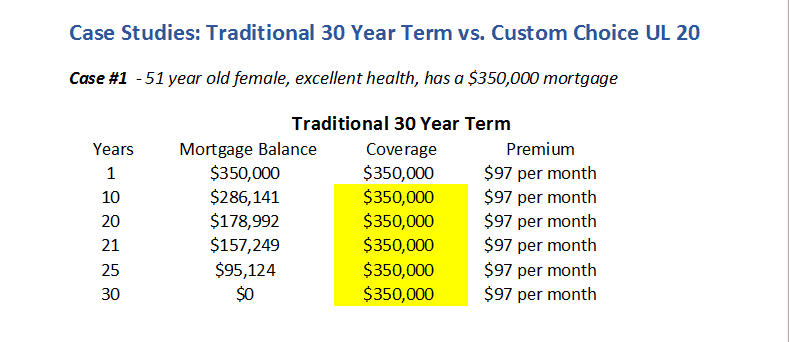

There are a few various kinds of home loan protection insurance coverage, these include:: as you pay even more off your home mortgage, the amount that the policy covers lowers in accordance with the exceptional equilibrium of your home loan. It is the most typical and the cheapest kind of mortgage protection - mortgage insurance death of spouse.: the quantity insured and the costs you pay remains level

This will settle the home loan and any type of continuing to be balance will certainly go to your estate.: if you wish to, you can add serious disease cover to your home mortgage protection plan. This suggests your home mortgage will certainly be cleared not just if you die, but likewise if you are detected with a serious ailment that is covered by your policy.

Mortgage Insurance Payout

Additionally, if there is an equilibrium continuing to be after the home loan is cleared, this will certainly go to your estate. If you transform your mortgage, there are numerous things to think about, relying on whether you are topping up or extending your home loan, changing, or paying the home mortgage off early. If you are topping up your mortgage, you need to make sure that your plan fulfills the brand-new value of your home loan.

Compare the prices and advantages of both choices (how much is mortgage protection insurance calculator). It may be less expensive to keep your initial mortgage defense plan and after that acquire a 2nd policy for the top-up amount. Whether you are topping up your mortgage or extending the term and require to obtain a brand-new policy, you might find that your costs is more than the last time you obtained cover

Life Insurance For Home Mortgage

When switching your home mortgage, you can appoint your home mortgage defense to the new loan provider. The premium and level of cover will be the exact same as before if the amount you obtain, and the term of your home mortgage does not transform. If you have a plan via your lending institution's team system, your lender will certainly terminate the policy when you switch your home loan.

There won't be an emergency situation where a large bill schedules and no other way to pay it so soon after the fatality of a liked one. You're providing satisfaction for your family! In The golden state, home mortgage security insurance covers the entire superior equilibrium of your loan. The survivor benefit is an amount equivalent to the equilibrium of your mortgage at the time of your death.

Discount Mortgage Life Insurance

It's vital to recognize that the survivor benefit is provided directly to your financial institution, not your liked ones. This assures that the staying financial debt is paid in full and that your enjoyed ones are spared the monetary strain. Mortgage security insurance can additionally provide short-term protection if you become impaired for an extended duration (generally 6 months to a year).

There are lots of benefits to getting a mortgage security insurance coverage in California. Several of the top benefits include: Assured authorization: Also if you're in inadequate wellness or operate in a harmful occupation, there is ensured authorization without any clinical exams or lab examinations. The very same isn't real permanently insurance policy.

Impairment defense: As stated over, some MPI plans make a few mortgage repayments if you come to be impaired and can not generate the exact same revenue you were accustomed to. It is necessary to note that MPI, PMI, and MIP are all various sorts of insurance coverage. Mortgage defense insurance (MPI) is designed to repay a home mortgage in case of your fatality.

Mortgage Payment Protection Insurance Claims

You can also apply online in mins and have your plan in position within the same day. For even more details concerning getting MPI protection for your home mortgage, contact Pronto Insurance coverage today! Our educated representatives are right here to address any kind of concerns you might have and supply further assistance.

It is a good idea to compare quotes from various insurers to discover the most effective price and insurance coverage for your needs. MPI supplies a number of advantages, such as satisfaction and streamlined certification procedures. It has some restrictions. The survivor benefit is straight paid to the loan provider, which restricts versatility. Furthermore, the advantage amount lowers in time, and MPI can be much more costly than standard term life insurance policy plans.

Is Mortgage Insurance The Same As Home Insurance

Get in fundamental details regarding on your own and your mortgage, and we'll contrast prices from various insurance companies. We'll likewise show you just how much insurance coverage you need to protect your home mortgage. Get begun today and provide on your own and your family the tranquility of mind that comes with knowing you're safeguarded. At The Annuity Specialist, we understand home owners' core issue: guaranteeing their family members can preserve their home in the occasion of their death.

The primary benefit below is clarity and confidence in your choice, recognizing you have a strategy that fits your requirements. When you accept the plan, we'll deal with all the paperwork and setup, guaranteeing a smooth implementation procedure. The positive result is the assurance that comes with knowing your family is safeguarded and your home is safe and secure, regardless of what occurs.

Expert Advice: Assistance from seasoned experts in insurance coverage and annuities. Hassle-Free Configuration: We manage all the documentation and execution. Affordable Solutions: Discovering the best coverage at the most affordable possible cost.: MPI especially covers your home loan, offering an added layer of protection.: We work to discover one of the most affordable options customized to your budget plan.

They can give information on the protection and advantages that you have. Typically, a healthy and balanced individual can expect to pay around $50 to $100 each month for mortgage life insurance policy. It's recommended to obtain a tailored home loan life insurance coverage quote to get a precise quote based on individual conditions.

Table of Contents

Latest Posts

1 Life Funeral Cover Quotes

Sell Burial Insurance

Which Is The Best Funeral Plan

More

Latest Posts

1 Life Funeral Cover Quotes

Sell Burial Insurance

Which Is The Best Funeral Plan