All Categories

Featured

Table of Contents

A level term life insurance policy policy can give you satisfaction that individuals that depend upon you will have a survivor benefit throughout the years that you are preparing to support them. It's a means to assist care for them in the future, today. A level term life insurance policy (sometimes called degree premium term life insurance policy) policy gives insurance coverage for an established number of years (e.g., 10 or 20 years) while keeping the premium settlements the very same throughout of the policy.

With degree term insurance, the cost of the insurance will certainly remain the exact same (or potentially decrease if rewards are paid) over the regard to your policy, normally 10 or twenty years. Unlike irreversible life insurance, which never expires as long as you pay costs, a degree term life insurance coverage plan will finish eventually in the future, usually at the end of the period of your degree term.

Term Life Insurance Level Term Explained

Due to this, many individuals use long-term insurance policy as a steady financial planning device that can offer many demands. You may have the ability to transform some, or all, of your term insurance policy during a collection duration, commonly the first ten years of your plan, without needing to re-qualify for protection also if your wellness has altered.

As it does, you may want to include to your insurance policy coverage in the future - Term Life Insurance. As this takes place, you might desire to eventually minimize your death benefit or consider transforming your term insurance coverage to a permanent policy.

As long as you pay your premiums, you can rest very easy knowing that your liked ones will get a fatality benefit if you die during the term. Lots of term plans permit you the ability to convert to long-term insurance coverage without needing to take another health test. This can enable you to make the most of the added benefits of a long-term plan.

Level term life insurance coverage is just one of the easiest courses into life insurance policy, we'll talk about the benefits and downsides to ensure that you can select a plan to fit your needs. Degree term life insurance policy is one of the most common and standard kind of term life. When you're searching for short-lived life insurance policy strategies, level term life insurance coverage is one path that you can go.

The application procedure for level term life insurance policy is commonly really uncomplicated. You'll submit an application that contains basic individual info such as your name, age, and so on along with a much more in-depth survey regarding your medical background. Depending on the plan you're interested in, you might need to join a medical exam process.

The brief solution is no., for instance, let you have the comfort of fatality benefits and can accumulate cash money value over time, indicating you'll have a lot more control over your benefits while you're alive.

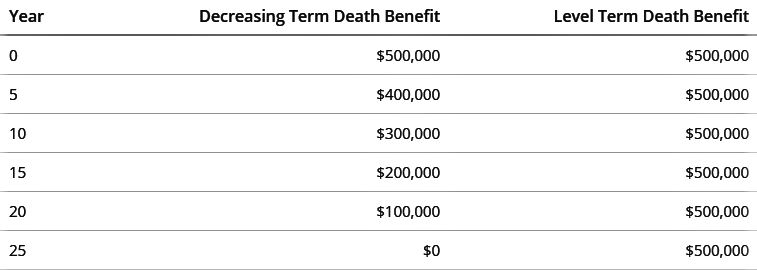

What is Level Term Vs Decreasing Term Life Insurance? Key Considerations?

Bikers are optional provisions added to your plan that can offer you extra advantages and protections. Anything can happen over the course of your life insurance policy term, and you desire to be ready for anything.

This rider provides term life insurance policy on your children with the ages of 18-25. There are instances where these advantages are developed into your plan, but they can likewise be offered as a different addition that calls for added payment. This motorcyclist offers an additional fatality advantage to your recipient needs to you die as the result of an accident.

Table of Contents

Latest Posts

1 Life Funeral Cover Quotes

Sell Burial Insurance

Which Is The Best Funeral Plan

More

Latest Posts

1 Life Funeral Cover Quotes

Sell Burial Insurance

Which Is The Best Funeral Plan